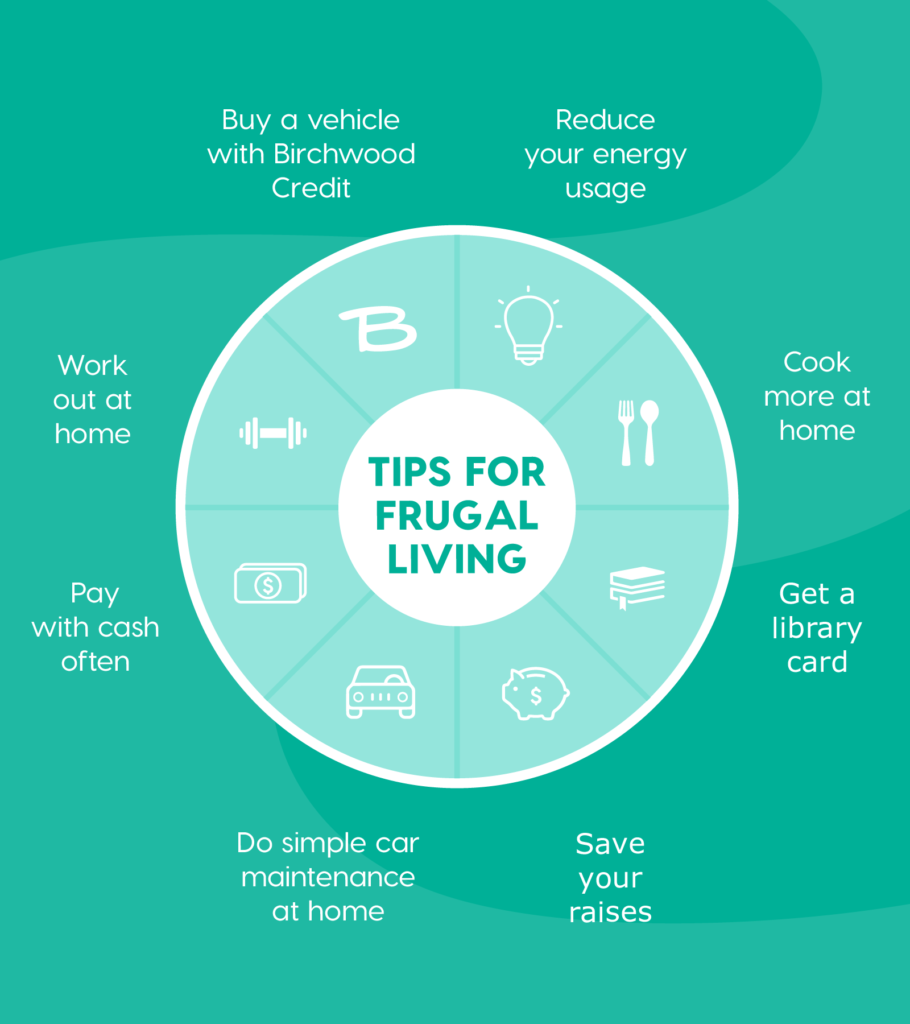

20 Tips for Frugal Living in Canada

Living frugally does not mean sacrificing your basic needs. It’s about prioritizing your spending and saving strategically so you have money for things you really need.

We’ve compiled a list of tips on how to master frugal living in Canada by cutting your spending and saving in creative ways. Learn ways to save on groceries, around the home and on finances so you can get savvy at saving – and see results!

20 tips for frugal living in Canada

1. Create a budget

Anyone who’s ever had to save money will tell you to create a budget – and for good reason. Create a spreadsheet with your spending categories and allocate a certain amount to spend in each category per month. Be realistic and only spend what you can afford (and don’t forget to put money into savings).

2. Eat out less

This one is easier said than done but it’s ultimately worth it if you can do it. Pack a lunch for work and cook dinner at home as often as you can. Wondering what to do for date night? Cook a meal and have an indoor picnic! You’ll have just as much fun and save money.

3. Reduce your energy usage

Your energy bill is likely one of your largest expenses. To cut down on costs, there are many simple things you can do around the house. Unplug electronics when you aren’t using them. Keep lights turned off until you need them. Hang your laundry to dry. With a few small changes, you can end up reducing your energy bill and saving massive dollars in the long run.

4. Do simple car maintenance at home

Surely we should all leave some car maintenance to the professionals, but why not save a few bucks and do the simple things yourself? There are plenty of YouTube videos and articles that will walk you through how to do an at-home oil change.

And that’s not all you can do. Next time you’re thinking of going through the car wash, why not opt for a bucket of soapy water at home? If you can learn some basic car DIYs, you’ll learn something new while saving a few bucks.

5. Head to the thrift shop

The next time you need a new outfit, head to the thrift shop! It’s better for the environment and your wallet – plus you’ll likely find something completely unique that won’t be on a rack in a big box store.

6. Don’t store too much in your vehicle

The lighter you drive, the better on fuel your vehicle will be. Each extra pound your vehicle carries lowers its fuel efficiency, burning fuel faster and making you fill up more frequently. If you keep your vehicle storage to a minimum, your fuel will last longer.

7. Work out at home

You don’t need a gym to exercise. Even a few at-home essentials like free weights, resistance bands and a mat are a small investment for your fitness and your health. You’ll avoid the pricey fees of a gym and still get a great workout.

8. Check out the dollar store

If you need the staples like Ziploc bags, dish soap, tape or kitchen utensils, head to the dollar store. You can get the same items you’d see at a regular grocery store for much cheaper.

9. Get a library card

Books are pricey and if you’re an avid reader, it’ll start to add up. Opt for a library card – you pay a yearly fee and you can read as much as you want. You’ll also have access to movies, games, classes and other activities.

If you’d rather not leave your comfy couch, grab your phone and try a free audiobook from audible. If you have an eReader, Kindle offers many eBooks for under $5, including free books. There’s plenty to choose from – all you need is the internet.

10. DIY projects

The more you can do yourself, the less you’ll have to pay other people to do work for you. It can be anything from repairing a hole in a shirt or staining your deck during the summer. You can save a lot of money by completing projects yourself!

11. Buy in bulk

If you can, buy non-perishable items in bulk when they’re on sale. Bulk Barn and Scoop & Save Health Foods are excellent local options! You can also purchase large quantities of meat when it’s on sale and freeze most of it. You’ll have a good stock of meat for a fraction of the price and all you have to do is pull it out of the freezer when you’re ready to cook.

12. Don’t grocery shop on an empty stomach

Always eat before heading to the grocery store. If you shop on an empty stomach, you’ll probably want to buy more than what you need. It’s also a good idea to prepare a list beforehand so you have a clear idea of what you actually need for the week ahead.

13. Use coupons

Show and Save books exist for a reason. Anytime you can use a coupon, go for it! Even a small discount is better than nothing and will ultimately save you more in the long run.

14. Buy quality items

It’s important to find a balance between quality and cost but you’ll be happier if you buy an item that will last. If you always purchase cheap items, you’ll have to replace them more often and you’ll end up spending more on the same items. However, if you purchase a good-quality item the first time around, you probably won’t have to replace it for a while.

15. Shop for holiday decorations in the off-season

Ever notice how the day after Valentine’s Day, all the chocolate is 50 per cent off? The same goes for holiday decorations. If you need to stock up for next year, consider doing your shopping after the holiday instead of before and save those items for the following year.

16. Save your raises

You got a raise at work – congratulations! Instead of spending your raise or bonus, think about saving that money instead. Just because your salary increases doesn’t mean your spending should. It’s a great opportunity to put more money away and grow your savings.

17. Pay with cash more often

If you pay with cash, you’ll have a better idea of when it’s starting to run out. Give yourself a cash budget for the week for things like coffees or lunches out. Once your cash runs out, you’ll know you’ve hit your budget for the week.

18. Look for a bank account with no fees

If you can find one, a zero-fee bank account is an excellent way to cut down on small expenditures. Gaining back even $10 a month will add up over time and it’ll be one less expense out of your pocket.

19. Save regularly

Part of the reason living frugally is important is being able to put money away into savings. If you live frugally, it should be easier to save money each month for future purchases or retirement.

20. Buy a vehicle with Birchwood Credit

If you need a new vehicle and are looking for an affordable payment plan, our credit experts can help you get approved. We lend our own money which means we can give better rates, faster approvals and more affordable payment terms.

You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle. You can also reach out for a complimentary credit check.

Our offices have reopened though if you’d prefer to shop from the comfort of your home, you still can with our Buy From Home program. Your entire buying experience will be 100% contactless from the loan approval and vehicle shopping to the test drive and delivery. You’ll even get a $1000 rebate and other added benefits. Visit our Buy From Home page for more information.