What Is the Average Credit Score in Canada by Age?

Your credit score says a lot about how you manage your finances. Lenders look at your credit score to determine if they consider you a reliable borrower – it has a huge impact on the type of loans you’ll get approved for and in turn, the type of purchases you’ll be able to make.

We’ll walk you through the average credit score in Canada by age and examine credit score ranges, factors that affect your credit score and ways you can build credit, no matter your age.

Key Takeaways

- Your credit score is a three-digit number between 300-900.

- Credit scores vary by age with 65+ having the highest average score in Canada.

- Various factors influence your credit score including payment history.

- Paying bills on time and reducing debt can improve your score.

- Maintaining a good credit score is better for borrowing.

What is a credit score?

A credit score is a three-digit number between 300 and 900 that represents your credit risk. Your credit risk is the likelihood that you’ll pay your bills on time or pay back a loan on the terms agreed upon. The higher your credit score, the lower your lending risk, which means more lenders will want to approve you for new credit. Many factors can influence your credit score (but we’ll get to that a little later).

How Credit Scores Work

Your credit score is an important piece of your financial footprint. It allows you to buy a new vehicle, get approved for a mortgage, and simply make purchases on your credit card. If your credit score is high, you’ll have access to more financial opportunities with better rates. It’s important to understand what your credit score means and how it will impact your ability to get approved for new credit. In order to do that, you need to get your credit report.

What is a good credit score?

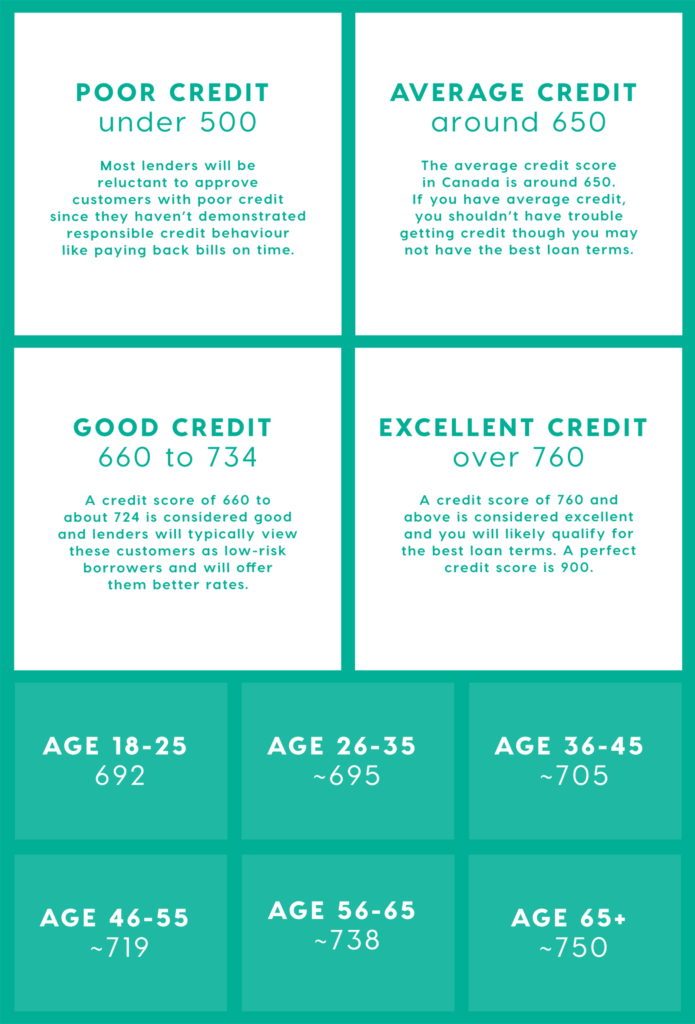

Credit scores fall in a range between 300 and 900. We’ve broken down this range into four categories based on Equifax’s metrics: poor, average, good and excellent. Let’s explore these different categories.

Poor Credit

Most lenders will be reluctant to approve customers with a credit score under 500. People in this category likely haven’t demonstrated responsible credit behaviour like paying back bills on time, or they may have incurred large amounts of debt.

At Birchwood Credit, we look at your entire financial situation, not just your credit score and we approve all credit types.

Average Credit

The average credit score in Canada is around 650. People who fall into this category don’t have a perfect credit record, though it’s also not terrible. Having average credit should open up more lending opportunities but you may not be offered the best loan terms.

Good Credit

A credit score of 660 to about 724 is considered good and lenders will typically view these customers as low-risk borrowers. They’ll likely be offered better interest rates as they’ve demonstrated responsible credit behaviour. Scores from 725 to 759 are considered very good.

Excellent Credit

A credit score of 760 and above is considered excellent and you will likely qualify for the best loan terms. If you reached 900, you would have a perfect credit score. People in this category have demonstrated exceptional credit behaviour and have proven they’re extremely responsible to potential lenders. Lenders will have the confidence that they will be reliable borrowers.

Generally speaking, the higher your credit score, the more likely you’ll be offered a better (lower) interest rate than people who have bad credit.

At Birchwood Credit, we want to approve you for a car loan, even if you have bad credit. We look at your entire financial situation, not just your credit score, and we approve all credit types. To learn more about our bad credit car loans, click here.

Read more: Learn What is a Good Credit Score in Canada

How Credit Reporting Works

Credit bureaus collect and maintain a history of your credit activity reported by the lenders and creditors you have accounts with. They also retain other personal information such as bankruptcies and debts that have gone to collections. Each creditor can choose to report the status of your account and payment history to the credit bureaus. Financial institutions and other lenders can request a copy of your credit report in order to approve you for lending or borrowing. For example, when you apply for a new loan or credit card, a lender may look at your current credit report to determine whether to lend you money or not and at what rate.

What is the Average Credit Score in Canada by Age?

Equifax Canada surveyed credit scores from various age ranges for a full decade. They released the results in their latest 2018 Generational Study.

Their data breaks down the average credit score in Canada by age group as follows:

- Age 18-25: 692

- Age 26-35: ~695

- Age 36-45: ~705

- Age 46-55: ~719

- Age 56-65: ~738

- Age 65+: ~750

Equifax found that credit scores in the 18-25 age range increased by 11 points over the decade while all other age groups saw small decreases. Equifax estimated this increase was due to millennials developing better saving habits early on and learning from older generations.

The data also shows that the older you are, the better your credit score. Equifax speculated this is caused by older people having more time to take on credit, build credit and pay off credit, therefore earning a higher credit score (as they had more time to do the work).

That being said, just because you’re older doesn’t guarantee you’ll have a near-perfect credit score, nor does being younger mean you won’t have good credit. Building and maintaining good credit takes effort and smart money-managing habits.

Other Credit Score Facts

Equifax found that credit scores in the 18-25 age range increased by 11 points over the decade while all other age groups saw small decreases. Equifax estimated this increase was due to millennials developing better saving habits early on and learning from older generations.

The data also shows that the older you are, the better your credit score. Equifax speculated this is caused by older people having more time to take on credit, build credit, and pay off credit, therefore earning a higher credit score (as they had more time to do the work).

That being said, just because you’re older doesn’t guarantee you’ll have a near-perfect credit score, nor does being younger mean you won’t have good credit. Building and maintaining good credit takes effort and smart money-management habits.

Factors that can affect your credit score

How you interact with credit impacts your credit score. Your age is a factor, but it’s not the only one. The younger you are, the fewer major purchases you’ve made, and the less debt you’ve likely incurred and built. However, with smart money-managing habits, you can build credit and maintain a good credit score.

Here are some factors that can either raise or lower your credit score:

Payment History

Simply put, if you pay your bills on time, your credit score will increase over time. If you miss payments, your credit score will decrease. How you handle (or don’t handle) payments will impact your score.

Your Debt-To-Credit Ratio

The more debt you owe, the lower your credit score will likely be. If you miss payments, you aren’t proving to the lender that you will meet the loan requirements and your score will drop.

The Length Of Your Credit History

The longer you’ve had open credit, the better opportunity you’ve had to build good credit. In other words, the longer you’ve been paying back credit on time, the higher your credit score should be. On the flip side, the less credit you’ve had over a short period of time, the lower your score may be since you haven’t had a chance to use it and build your reputation.

New Credit

The more credit products you have, and the more variety, the better your score. This gives you the opportunity to show lenders you can manage many different products responsibly (like a credit card, mortgage, and car payments).

Credit Inquiries

Your credit score takes a small and temporary hit each time a lender accesses your file. However, your score will drop if you apply for a bunch of new credit in a short period of time. This does not apply to pre-approvals or personal credit report requests.

How You Can Improve Your Credit Score

If your credit score isn’t where you want it to be, don’t worry. There are many small changes you can make that will help you build your score over time. Here are a few of our tips:

- Take out new credit. Taking on new credit, like car payments, and making those payments on time will help you build credit.

- Automate your payments. You won’t miss payments if they happen automatically! Save yourself the hassle and keep them automated.

- Pay your credit card balance in full. The less money you have on your credit card, the better. If you pay off your bill in full each month, you’ll avoid interest fees and build credit.

- Borrow what you can afford. Try not to live beyond your means. Borrowing what you can afford means you should have the funds to pay it back and maintain good credit.

Financing A Vehicle With Bad Credit

At Birchwood Credit, we look at your entire financial situation – not just your credit score – and we approve all credit types. We offer in-house financing which means we truly lend our own money. What does that mean for you? Better rates, payment terms and loan options.

If you want to budget for your car before you apply, you can try our online Car Loan Calculator. Our tool lets you adjust your loan payment and duration to estimate your monthly payments. There’s a lot more to borrowing money than just the loan – read our blog post about the true cost of borrowing to learn more.

Now that you’ve got some great tips on how to build good credit, maybe you’re thinking about ways to improve yours. Perhaps it’s by taking out a new car loan? You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle. You can also reach out for a complimentary credit check.

Our offices have reopened though if you’d prefer to shop from the comfort of your home, you can with our Buy From Home program. Your entire buying experience will be 100% contactless from the loan approval and vehicle shopping to the test drive and delivery. You’ll even get a $1000 rebate and other added benefits. Visit our Buy From Home page for more information.