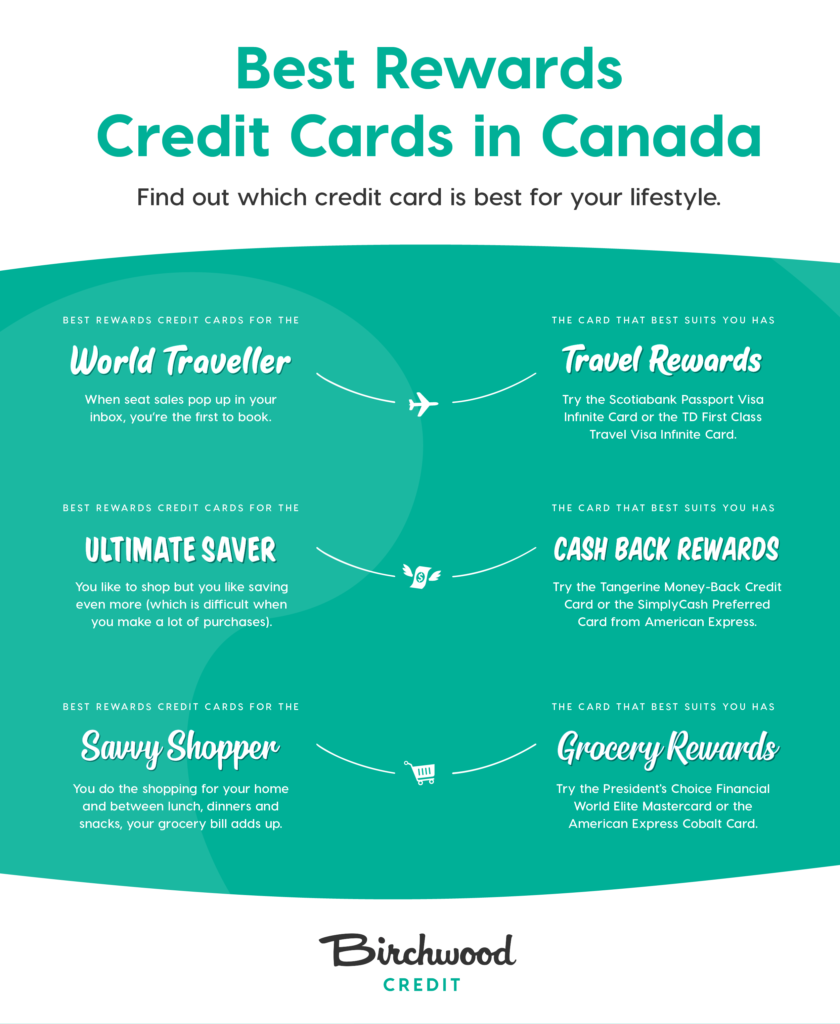

2020’s Best Rewards Credit Cards in Canada: Highest Cashback & Travel Perks

Many of us use credit cards to pay our bills, buy groceries and travel. Living inevitably costs money, so if there’s a way to get something in return for spending, who wouldn’t be interested?

That “something” is called the rewards card.

We’re here to help you choose the best rewards card in Canada for you, whether you’re looking to save on groceries, travel or simply want cash back! We’ve done the research on the best options to date and included some tips on how to decide which rewards card is right for you.

Best Rewards Cards for Groceries

Everyone needs to eat, so if you can save when you spend, it’s a bonus! Here are a couple of the best rewards cards when it comes to saving on groceries.

1. American Express Cobalt Card

Preferred credit score: fair to good

Annual fee: $120

Card perks:

- Earn five points for every $1 spent on eligible restaurants, bars, food delivery and groceries

- Earn two points for every $1 spent on eligible travel including hotel, gas and ground transportation like taxi or transit

- For all other purchases, you’ll earn one point for every $1 spent

- Get 30,000 bonus points when you sign up (terms and conditions may apply)

- Get exclusive entertainment deals and travel perks

You can redeem your points on:

- Groceries

- Flights

- Concerts and events

- Streaming services

- Food & drink

- Retail (including Amazon)

- Statement credit

2. President’s Choice Financial World Elite Mastercard

Preferred credit score: fair to good

Annual fee: N/A

Minimum income: $80,000 personal income or $150,000 household income

Card perks:

- Earn 30 PC Optimum points for every $1 spent on groceries at No Frills, Real Canadian Superstore and others (see site for details)

- Earn 45 points for every $1 spent at Shoppers Drug Mart

- Earn 10 points for every $1.50 spent everywhere else

- Get access to travel emergency and car rental insurance

Once you’ve reached 10,000 points, you can redeem up to $10 on:

- Groceries and products at participating stores

- Beauty products at Shopper’s beauty boutique

- Joe Fresh apparel

- Other products on PC Express websites

All you have to do is present your card at the till to redeem your grocery money.

Best Rewards Cards for Travel

If you’ve been bit by the travel bug, we bet you’re looking for the best deal on your next adventure (even if it’s local). Here are some of the best rewards cards to help you save when you travel.

1. Scotiabank Passport Visa Infinite Card

Preferred credit score: good to excellent

Annual fee: $139

Minimum income: $60,000

Minimum credit limit: $5,000

Card perks:

- Earn up to 40,000 Scotia Rewards bonus points in your first year

- Earn 30,000 bonus points when you spend $1,000 in everyday purchases in the first three months

- Earn 10,000 bonus points when you spend at least $40,000 in everyday eligible purchases annually

- Earn two rewards points on every $1 spent on eligible groceries, dining, entertainment and transit

- Earn one rewards point on every $1 spent on all other eligible purchases

- Receive insurance coverage for the following (and more): travel emergencies, trip cancellation, flight delay, lost baggage, rental car collision, purchase security

- Don’t pay any foreign transaction fees

- Get six complimentary airport lounge visits per year

- Save on car rentals and book trips faster

You can redeem your points on:

- Travel

- Statement credit

- Merchandise and tech

You can try the Scotiabank Rewards Comparison calculator to evaluate which Scotiabank card could be the best fit for you.

2. TD First Class Travel Visa Infinite Card

Annual fee: $120

Minimum income: $60,000 personal or $100,000 annual household income

Minimum credit limit: $5,000

Card perks:

- Apply by September 8, 2020 to get 20,000 bonus TD points when you make your first purchase and you’ll have no annual fee for your first year

- Earn nine points for every $1 spent when you book travel online through Expedia For TD

- Earn three points for every $1 spent on other purchases made using your card

- TD Points don’t expire as long as you’re a cardholder

- Get travel benefits including travel medical insurance, trip cancellation insurance, delayed and lost baggage insurance and more

- Save on rental cars, insurance, and accommodations

You can redeem your points on:

- Travel and travel-related purchases

- Retail merchandise

- Gift cards

- Cash credits to your account

Best Rewards Cards for Money Back

If you make a lot of purchases and are looking for the best bang for your buck, maybe a card with cash-back options will be the best fit for you! Read on to learn more and check out our blog post for 20 tips for frugal living in Canada.

1. Tangerine Money-Back Credit Card

Annual fee: N/A

Card perks:

- Earn 2%Money-Back Rewards on everyday purchases in two 2% Money-Back Categories of your choice

- Earn 0.5% Money-Back Rewards on all other everyday purchases

- Money-Back Rewards can be applied to your credit card balance or redeemed into your savings account

- Get Purchase Assurance and Extended Warranty coverage

- No limit on how many rewards you can earn

- No annual fee

You can redeem your points in two of the following 2% Money-Back Categories:

- Grocery

- Furniture

- Restaurants

- Hotel/motel

- Gas

- Recurring bill payments

- Drug store

- Home improvement

- Entertainment

- Public transportation and parking

2. SimplyCash Preferred Card from American Express

Annual fee: $99

Card perks:

- Earn 5% cash back in your first six months on everything you buy with the card

- Earn 2% cash back after your first six months

- Earn a bonus of $100 cash back for each approved referral

- Get exclusive access to music, theatre, dining, film and shopping experiences

- Get insurance coverage for car rental theft and damage

- No limit to how much cash back you can earn

You can redeem your points on whatever you’re shopping for. Whether it’s travel, groceries or entertainment, the choice is yours. Learn more about redeeming your rewards.

How to choose the right rewards card for you?

There are hundreds of rewards cards in Canada which can make for a tough decision. Before you sign on to a new card, give our tips some thought and think about what you really want out of a rewards card before committing.

Ask yourself if having a rewards card makes sense for you

Be honest with yourself. Do you pay off your credit card on time each month and in full? Or do you struggle to make payments and end up paying interest? Rewards cards are truly rewarding when you make your payments on time and don’t collect interest. Most rewards cards have high interest rates so it’s only best to sign up if you know you’ll have no trouble with payments and can avoid paying interest.

Ask yourself what you want out of a rewards card

Are you really interested in travelling? Is it important to save as much as you can on groceries? Or would you love some extra cash to remove some of the burden of daily purchases? Think about the types of rewards that would mean the most to you and find a card that will address your needs.

See if there’s an annual fee or other eligibility requirements

If the rewards card has a hefty annual fee, maybe it’ll turn you away from signing up. Many rewards cards also have a minimum income requirement or minimum credit limit, so make sure you qualify before deciding on a card.

Research the other rewards card perks

Many rewards cards have additional insurance coverage and travel benefits like airport lounge access. Some even waive foreign transaction fees. Make sure you read the fine print as there could be other savings besides the points you earn!

Repair your credit with Birchwood Credit

Spending habits can make or break your credit score. Building good credit habits is crucial in maintaining or repairing your credit score and achieving financial independence.

If you don’t know what your credit score is, you’re not alone. Our guide, Rebuilding and Repairing Your Credit Score, will help you learn more about your credit score, how it works and how you can rebuild it if it’s not where you’d like it to be.

Download the guide today and take the first step in improving your financial health.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle. You can also reach out for a complimentary credit check.

Our offices have reopened, though if you’d prefer to shop from the comfort of your home, you still can with our Buy From Home program. Your entire buying experience will be 100% contactless from the loan approval and vehicle shopping to the test drive and delivery. You’ll even get a $1000 rebate and other added benefits. Visit our Buy From Home page for more information.