Credit Score Guide: What Is the Credit Score Range in Canada?

Your credit score is an important piece of your financial footprint. It allows you to buy a new vehicle, get approved for a mortgage and simply make purchases on your credit card. If your credit score is high, you’ll have access to more financial opportunities with better rates.

We’ll walk you through credit score ranges in Canada, how to check your credit so you know where you stand, and give you ways you can rebuild your credit so you can get closer to achieving your financial goals.

What is the credit score range in Canada?

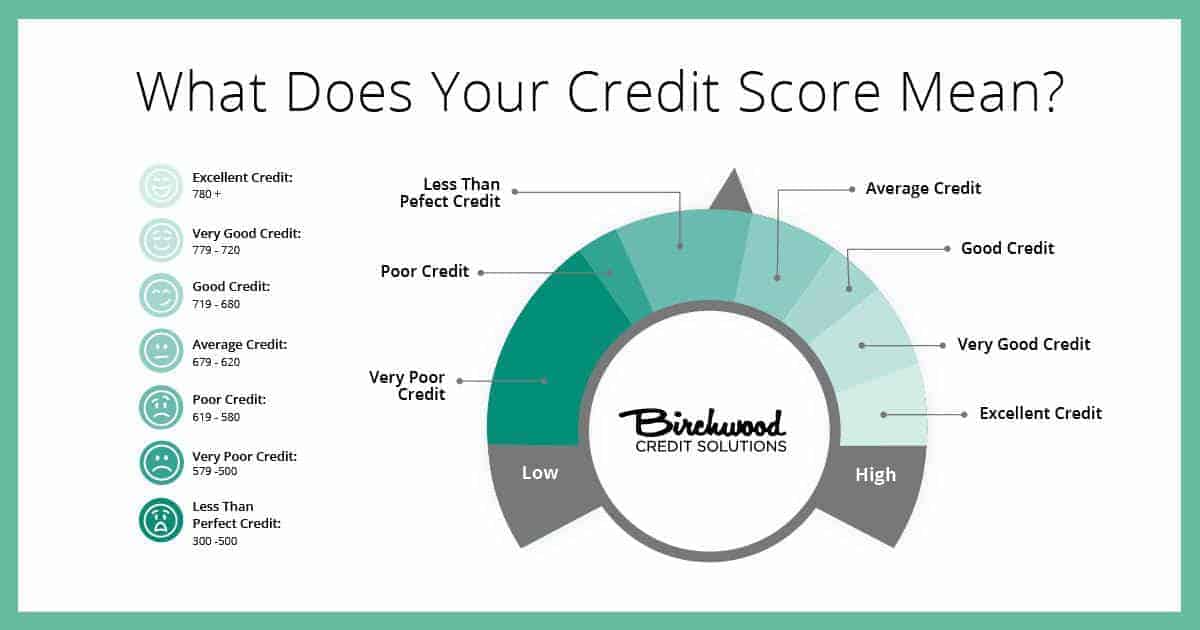

Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Credit risk is the likelihood you’ll pay your bills on time, or pay back a loan on the terms agreed upon.

In Canada, credit scores range from 300 (very poor) to 900 (excellent) with the average Canadian credit score sitting at 650. According to TransUnion, a score above 650 will likely qualify you for a standard loan, while a score under 650 will likely make it difficult for you to receive new credit.

It’s important to understand what your credit score means and how it will impact your ability to get approved for new credit. In order to do that, you need to get your credit report.

How to get your credit report in Canada

A credit report is a record of a borrower’s credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

What your credit score means

Once you’ve received your credit report, you’ll need to interpret your credit score to determine your creditworthiness. We’ve broken down the 300 to 900 credit score range into four categories based on Equifax’s metrics: poor, average, good and excellent. Let’s explore these different categories.

Poor credit

Most lenders will be reluctant to approve customers with a credit score under 500. People in this category likely haven’t demonstrated responsible credit behaviour like paying back bills on time, or they may have incurred large amounts of debt.

Unlike other lenders, we look at your entire financial situation, not just your credit score and we approve all credit types.

Average credit

The average credit score in Canada is around 650. People who fall into this category don’t have a perfect credit record, though it’s also not terrible. Having average credit should open up more lending opportunities but you may not be offered the best loan terms.

Good credit

A credit score of 660 to about 724 is considered good and lenders will typically view these customers as low-risk borrowers. They’ll likely be offered better interest rates as they’ve demonstrated responsible credit behaviour. Scores from 725 to 759 are considered very good.

Excellent credit

A credit score of 760 and above is considered excellent and you will likely qualify for the best loan terms. If you reached 900, you would have a perfect credit score. People in this category have demonstrated exceptional credit behaviour and have proven they’re extremely responsible to potential lenders. Lenders will have the confidence they will be reliable borrowers.

Generally speaking, the higher your credit score, the more likely you’ll be offered a better (lower) interest rate than people who have bad credit.

At Birchwood Credit, we want to approve you for a car loan, even if you have bad credit. We look at your entire financial situation, not just your credit score, and we approve all credit types. Learn more about our bad credit car loans.

How is your credit score calculated in Canada?

How you interact with credit impacts your credit score. If you develop smart money-managing habits, you can build credit and maintain a good credit score.

Here are some factors that determine how your credit score is calculated:

- Payment history: Simply put, if you pay your bills on time, your credit score will increase over time. If you miss payments, your credit score will decrease. How you handle (or don’t handle) payments will impact your score.

- Amount of debt owed: The more debt you owe, the lower your credit score will likely be. If you miss payments, you aren’t proving to the lender that you will meet the loan requirements and your score will drop. If you can, keep your balance under half the available credit you have and avoid running your balance up to the limit.

- Length of credit history: The longer you’ve had open credit, the better opportunity you’ve had to build good credit. In other words, the longer you’ve been paying back credit on time, the higher your credit score should be. On the flip side, the less credit you’ve had over a short period of time, the less your score may be since you haven’t had a chance to use it and build your reputability.

- Number of credit products: The more credit products you have, and the more variety, the better your score. This gives you the opportunity to show lenders you can manage many different products responsibly (like a credit card, mortgage and car payments).

- Public records: If you’ve claimed bankruptcy in the past or have had prior collection issues, these will be factored into your score.

- Credit inquiries: Your credit score takes a small and temporary hit each time a lender accesses your file. However, your score will drop if you apply for a bunch of new credit in a short period of time. This does not apply to pre-approvals or personal credit report requests.

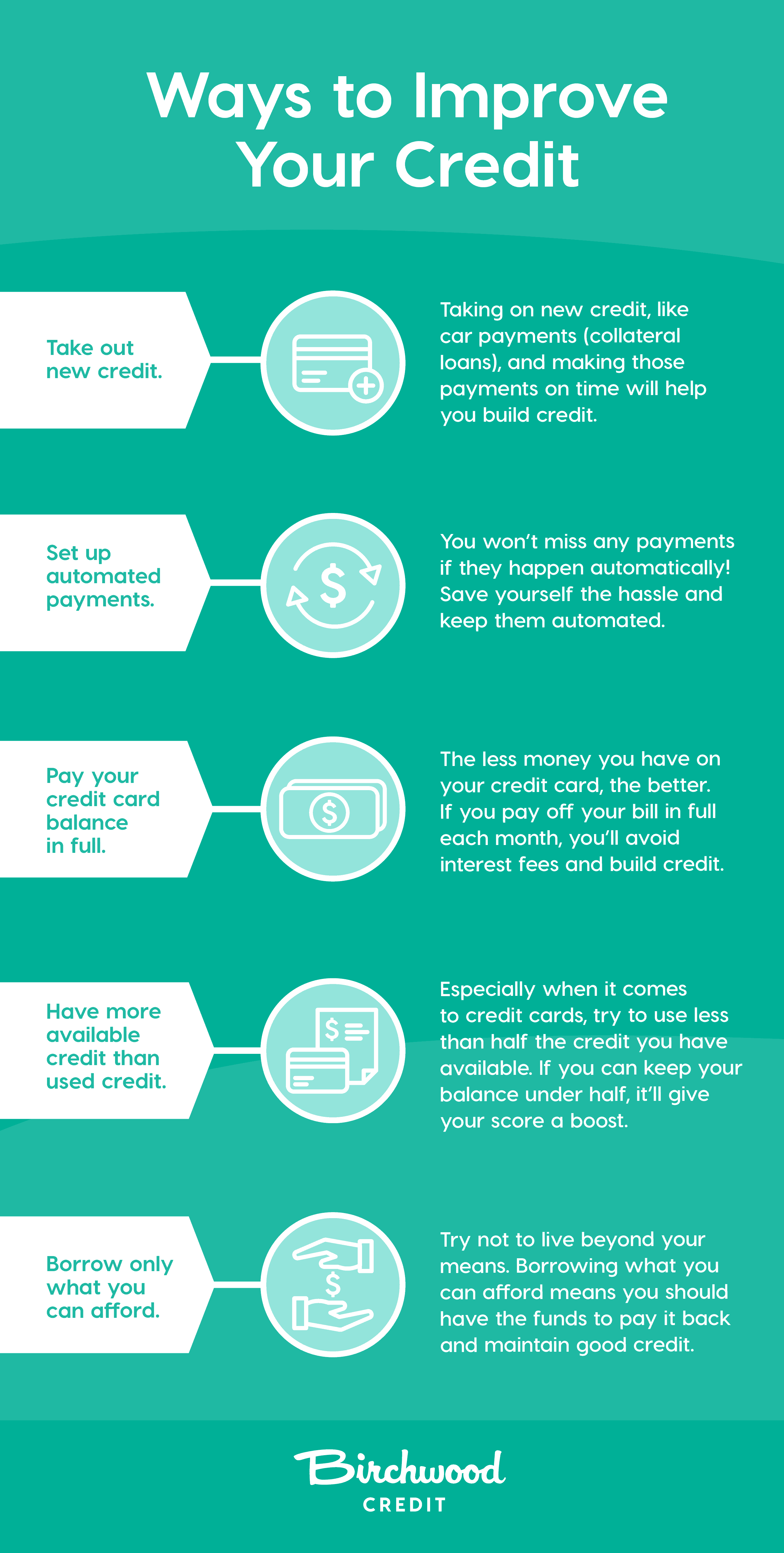

Tips on how to build good credit

If your credit score isn’t where you want it to be, don’t worry. There are many small changes you can make that will help you build your score over time. Here are a few of our tips:

- Take out new credit. Taking on new credit, like car payments (collateral loans), and making those payments on time will help you build credit.

- Automate your payments. You won’t miss payments if they happen automatically! Save yourself the hassle and keep them automated.

- Pay your credit card balance in full. The less money you have on your credit card, the better. If you pay off your bill in full each month, you’ll avoid interest fees and build credit.

- Have more available credit than used credit. Especially when it comes to credit cards, try to use less than half the credit you have available. If you can keep your balance under half, it’ll give your score a boost.

- Borrow what you can afford. Try not to live beyond your means. Borrowing what you can afford means you should have the funds to pay it back and maintain good credit.

Download our guide Repairing and Rebuilding Your Credit Score to learn more about your credit score, how it works and how you can rebuild it if it’s not where you’d like it to be.

How does Birchwood Credit evaluate credit?

At Birchwood Credit, we look at your entire financial situation – not just your credit score – and we approve all credit types. We offer in-house financing which means we truly lend our own money. What does that mean for you? Better rates, payment terms and loan options.

Check your credit with a Secure Credit Check from Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesn’t have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.